New-Vehicle Quality Improves Significantly over the Past Five Years, J.D. Power Finds

Hyundai and Maruti Suzuki Each Receive Initial Quality Awards in Three Segments

SINGAPORE: 30 Nov. 2017 — The number of problems reported per 100 vehicles (PP100) by new-vehicle owners has declined over the past five years, with declines reported across all problem categories except heating, ventilation and cooling (HVAC), according to the J.D. Power 2017 India Initial Quality StudySM (IQS), released today.

Overall, initial quality averages 95 PP100 in 2017, a significant improvement from 115 PP100 in 2013. All problems are summarized as the number of problems per 100 vehicles (PP100), with lower PP100 scores indicating a lower incidence of problems and, therefore, higher initial quality.

Although problems in the engine and transmission category remain the most frequently reported issues, there has been a significant improvement of 9 PP100 during the past five years (39 PP100 in 2013 vs. 30 PP100 in 2017). Problem reporting has either remained the same or has improved in all other categories except HVAC, with new-vehicle owners reporting more problems related to the quality of air conditioning effectiveness, compared to five years ago (22 PP100 in 2017 vs. 15 PP100 in 2013, respectively).

“With the advent of the lighter engine and power train introductions by vehicle manufacturers in the last five years, the number of engine, noise and vibration-related issues has declined considerably, resulting in better overall product quality,” said Kaustav Roy, Director at J.D. Power. “However, the challenge lies in optimizing customer requirements related to HVAC effectiveness while continuing to provide better engine power and fuel efficiency. Manufacturers that are able to integrate these customer requirements into their overall vehicle design would likely be in a better position to differentiate themselves from the competition.”

Following are some of the key findings of the study:

- Diesel models surpassing petrol models in initial quality: While both petrol and diesel models have shown strong improvements in initial quality since 2013, the rate of improvement for diesel models is much higher at 37 PP100, compared with petrol models, which have improved by 8 PP100.

- Audio and navigation problems: The number of problems reported in the audio, entertainment and navigation (AEN) category in 2017 remains the same as in 2013; however, the type of problems reported by new-vehicle owners in 2017 are increasingly focused on difficult to understand/ use of Bluetooth; hands-free communication; touch screen displays; and navigation.

- Explanation on the operation of features: Owners who received detailed explanations on the operation of their vehicle features at delivery report fewer problems than those who do not

(95 PP100 vs. 103 PP100, respectively).

Study Rankings

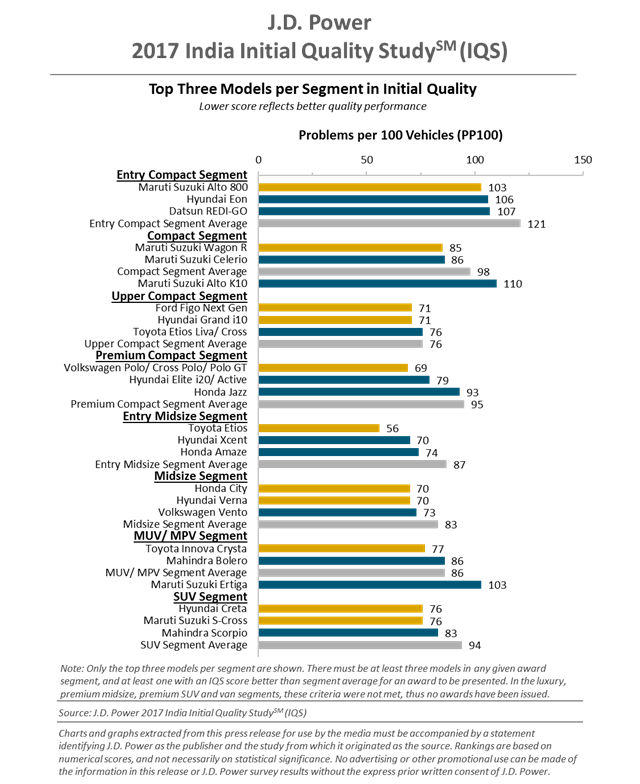

The Hyundai Grand i10 ties with Ford Figo Next Gen (71 PP100 each) for highest rank in the Upper Compact segment; the Hyundai Verna ties with Honda City (70 PP100 each) for highest rank in the Midsize segment; and the Hyundai Creta ties with Maruti Suzuki S-Cross (76 PP100 each) for highest rank in the SUV segment.

The Maruti Suzuki Alto 800 (103 PP100) and Maruti Suzuki Wagon R (85 PP100) rank highest in the Entry Compact and Compact segments, respectively.

Toyota also receives awards in two segments: the Etios (56 PP100) in the Entry Midsize segment and the Innova Crysta (77 PP100), in its debut year, in the MUV/ MPV segment.

The Volkswagen Polo/ Cross Polo/ Polo GT (69 PP100) ranks highest in the Premium Compact segment.

The 2017 India Initial Quality Study (IQS) is based on responses from 8,578 new-vehicle owners who purchased their vehicle from November 2016 through July 2017. The study includes 83 models from 17 makes. The study was fielded from May through September 2017 in 40 cities across India.

The study measures problems experienced by new-vehicle owners during the first two to six months of ownership and examines more than 200 problem symptoms in eight problem categories (listed in order of frequency of reported problems): engine/ transmission; heating, ventilation and cooling (HVAC); driving experience; vehicle exterior; features, controls and displays; vehicle interior; audio, entertainment and navigation (AEN); and seats.

About J.D. Power in the Asia Pacific Region

J.D. Power has offices in Singapore, Bangkok, Beijing, Shanghai and Tokyo that conduct customer satisfaction research and provide consulting services in the automotive, information technology and finance industries in the Asia Pacific region. Together, the five offices bring the language of customer satisfaction to consumers and businesses in Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Taiwan, Thailand and Vietnam. J.D. Power is a portfolio company of XIO Group, a global alternative investments and private equity firm headquartered in London, and is led by its four founders: Athene Li, Joseph Pacini, Murphy Qiao and Carsten Geyer. Information regarding J.D. Power and its products can be accessed through the internet at asean-oceania.jdpower.com.