Q1 FY21 adversely impacted by COVID 1 9

- Revenue ₹0KCr; PBT ₹ (6.2) KCr

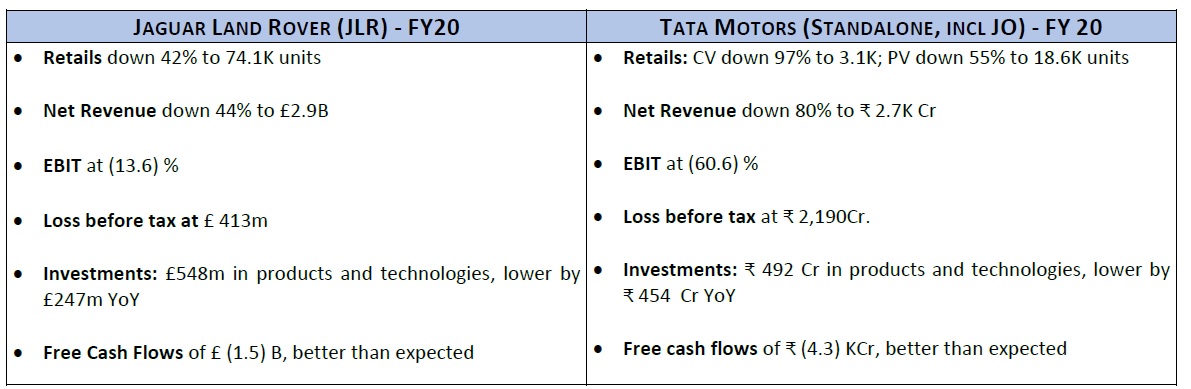

- JLR delivers PBT in line with last year despite 44% drop in revenue

- Cash outflow significantly lower than guidance and primarily due to working capital unwind

Mumbai, July 31, 2020: Tata Motors Ltd announced its results for quarter ending June 30, 2020.

JLR: The quarter reflected the full impact of COVID-19 with temporary retailer and plant shutdowns for most part of the quarter. However, the transformation programme continued to gain momentum resulting in positive EBITDA despite significant volume drop in the quarter and lower cash outflow as compared to the earlier expectations. Project Charge delivered £1.2b of cost, profit, and cash flow improvements in the quarter.

TML: In India, the nationwide lockdown resulted in the production and retailer shutdowns for major part of the quarter and heavily impacted the volumes. For TML, Q1 was marked by successful transition to BSVI and a sharp increase in PV market shares to 9.5% with the “New Forever” range. Negative operating leverage impacted the performance significantly. However, cash out flows were better than earlier expectations driven by the improvement initiatives which yielded ₹1020Cr of cash savings in the quarter.

Outlook: The outlook remains uncertain for the year with infections continuing to rise and intermittent lockdowns in many countries. However, we expect a gradual recovery of demand and supply in the coming months. In this context, we are committed to significantly deleveraging the business in the coming years and aim to generate positive free cash flows over last 3 quarters of the year by focusing on better front end activations of our exciting product range, and executing our cost and cash savings with rigour.

JAGUAR LAND ROVER (JLR)

HIGHLIGHTS

- Covid-19 resulted in temporary retailer and plant shutdowns, significantly impacting sales and profits

- Retail sales of 74,067 vehicles fell 42.4% y-o-y but improved month by month through the quarter with June down 9%

- Revenues of £2.9b and Loss before tax of £413m, only down slightly y-o-y after £500m of Charge+ cost actions

- Chery Jaguar Land Rover JV in China achieved breakeven in the quarter

- FCF outflow of £1.5b, includes £1.1b one-time working capital unwind and is about £500m better than guidance

- Charge+ delivered £1.2b of cost and cash improvement in the quarter and Jaguar Land Rover has increased the FY21 full year target further from £1.5b to £2.5b, raising the lifetime target to £6b

- Liquidity at 30th June was £4.7b, comprising £2.75b of cash and short term investments and £1.9b undrawn credit facility

FINANCIALS

The Covid-19 pandemic continued to significantly impact the business in Q1FY21, with retail unit sales down 42.4% year-on-year. However, monthly sales improved during the quarter across all regions as economies re-opened, with June sales down 24.9%. About 98% of Jaguar Land Rover’s retailers worldwide are now fully or partially open and all the company’s plants have resumed manufacturing, except for the Castle Bromwich facility, which will gradually restart from 10th August.

Revenue was £2.9b in the quarter and the company made a pre-tax loss of £413m. However, this was only down £18m year-on- year and the EBITDA margin was 3.5% with £500m of Charge+ cost actions substantially offsetting the lower sales. Free cash flow was negative £1.5b, primarily reflecting a one-time working capital outflow of £1.1b. Reassuringly, the Chery Jaguar Land Rover Joint Venture in China achieved break-even profits in the quarter. Overall, these results were better than expected with total cost and cash flow improvements of £1.2b realised in the quarter from the Charge+ program. The company successfully completed about

£650m of new funding and ended the quarter with solid liquidity of £4.7b including £2.75b of cash and short-term investments and

£1.9b undrawn revolving credit facility.

LOOKING AHEAD

Sales of the New Land Rover Defender started to ramp up in the UK, Europe and North America with China and other markets starting from July onwards. Plug-in hybrid and the Hard-Top commercial derivatives will be available later in the year. The expected recovery in sales will also be supported by the newly revealed enhancements to the Range Rover and Range Rover Sport. These flagship vehicles are now available with special editions and a suite of upgrades, including Jaguar Land Rover’s new 3.0-litre straight- six cylinder Ingenium diesel engine with Mild Hybrid Electric Vehicle technology. Both feature advanced connectivity with Apple CarPlay and Android Auto offered as standard. Passenger wellbeing has been enhanced with new Cabin Air Ionisation, which filters harmful particulates and improves interior air quality.

For the rest of FY21, Jaguar Land Rover will continue to manage costs and investment spending rigorously. After realising £1.2b of total cost and cash improvements under Charge+ in the quarter, the company has increased its target for FY21 from £1.5b to £2.5b. This brings the total Charge+ savings so far to £4.7b, with a target of £6b by the end of March 2021. While the outlook remains uncertain, we expect a gradual increase in sales, profitability and cash flow over the year. In Q2FY21, volumes may not pick up sufficiently to generate a profit, however, cash flow is expected to be positive, supported by improved working capital and continued savings. Investment spending is expected to be £2.5b for FY21.

Prof Sir Ralf Speth, JLR Chief Executive commented,

“Jaguar Land Rover has reacted with resilience and agility to the extraordinary challenges faced in the first three months of FY21 adapting rapidly to the widespread macroeconomic disruption and uncertainty. Through this period, we have continued to bring outstanding new vehicles to market, electrifying our multi-award-winning range and building the new Land Rover Defender, an icon reimagined for the digital age. As the lockdowns ease, we will emerge from the pandemic with our most advanced product range yet, and with the financial and operating measures in place to return to long-term sustainable profit. The fundamental strengths of Jaguar Land Rover have been tested in 2020, and we will pass this test to succeed in the future. Our exciting pipeline of new, advanced products places us at the forefront of our industry. We have a clear plan, a highly skilled, creative team, and unparalleled technical capabilities. I look forward to working with my successor Thierry Bolloré as Jaguar Land Rover focuses on its Destination Zero mission, and seeks to deliver the autonomous, connected, electric and shared experiences that our customers will love, for life with integrity.”

TATA MOTORS (STANDALONE INCL. JOINT OPERATIONS)

BUSINESS HIGHLIGHTS

- COVID-19 lockdown deeply impacted the volumes in both CV and PV

- Amidst subdued demand environment, Q1 was marked by successful transition to BSVI across the range of commercial vehicles and a steep improvement in PV market shares with our “New Forever” range incl. the newly launched Altroz

- Gradual restart of operations at plants and dealerships from mid-May

- CV retails at 3.1K. Market share in MHCV up 1440 bps as compared with FY20

- PV retails at 18.6K. Market share in Passenger Cars up 840 bps and UVs up 50 bps as compared with FY20

- Encouraging response to EVs, 289 EVs sold during the

- EBITDA margins impacted due to adverse mix and negative operating

- ₹ 1020Cr delivered out of the ₹ 6000Cr of cost and cash savings targeted for the

- Strong liquidity position as at end of the quarter amounting to ₹ 6.9 KCr

FINANCIALS

The Company responded quickly to the current crisis and instituted rigorous cost and investment controls to conserve cash as much as possible and managed the supply chain nimbly to restart operations as soon as possible in May-20 while taking care to ensure the safety of our employees.

In Q1FY21 wholesales (including exports) decreased 81.5% to 25,294 units. In the domestic volumes were down by: M&HCV -92.1%, ILCV -92.1%, SCV & Pick Ups -85.4% and CV Passenger -97.2%. Domestic PV volumes were down 60.6% .Overall domestic retails were lower than wholesales by 2.5K units as pipeline inventory in CV improves.

Revenue for the quarter decreased 80% to ₹2.7KCr and pre-tax loss before exceptional items was ₹2,141Cr (against pre-tax loss of ₹ 40Cr in Q1FY20) due to steep volume decline and negative operating leverage. Free cash flow for the quarter was ₹ (4.3) KCr, better than expected as the company drove the cost and cash savings agenda hard with ₹ 1020Cr delivered in Q1FY21. The investment spends were reduced significantly to ₹ 492 Cr for the quarter. The company ended the first quarter with a strong liquidity of ₹ 6.9 KCr.

LOOKING AHEAD

We look forward to a gradual pickup in demand and supply situation on the back of overall economic recovery expected in H2FY21. The company will focus on conserving cash by rigorously managing cost and investment spends to protect liquidity. The company has called out a cash improvement program of ₹ 6000Cr including a cost improvement program of ₹ 1500Cr. Capex is expected to be around ₹ 1500Cr for FY21. Due to these actions, the company expects improving cash flows for the remainder of the year and expects to end the FY21 with positive free cash flows.

Guenter Butschek, CEO and MD, Tata Motors, said,

“The COVID-19 pandemic has deeply impacted the auto industry in Q1FY21. Post a calibrated restart at all plants in mid-May, we gradually scaled up our capacity while prudently safeguarding the health and wellbeing of our employees as well as the larger ecosystem. Even as we continue to address the challenges, we see some disruption due to the intermittent shutdowns and supply chain bottlenecks. We have witnessed some green shoots emerging in PV owing to some pent up demand pre COVID, and are hopeful for a full recovery of the CV industry by end of the fiscal year, with a gradual pickup of demand, aligned to the economic recovery. We remain focused on making Tata Motors more agile to improve our market, operational and financial performance by reducing costs, generating free cash flows and providing the best in class customer experience.”

ADDITIONAL COMMENTARY ON FINANCIAL STATEMENTS

(CONSOLIDATED NUMBERS, IND AS)

FINANCE COSTS

Finance costs increased by ₹ 165Cr to ₹ 1,877Cr during Q1FY’21 vs prior year due to higher gross borrowings as compared to Q1FY’20

JOINT VENTURES, ASSOCIATES AND OTHER INCOME

For the quarter, net loss from joint ventures and associates amounted to ₹ 60Cr compared with a loss of ₹ 245Cr in prior year. Other income (excluding grants) was ₹ 228Cr versus ₹ 292Cr in the prior year

FREE CASH FLOWS

Free cash flow (automotive) in the quarter, was negative ₹ 18.2 KCr (as compared to negative ₹ 11.6K Cr in Q1FY 20) reflecting the adverse working capital and wider disruptions caused by the plant and retailer shutdowns across both India business and Jaguar Land Rover

TAX EXPENSES

The tax expenses for quarter ended June 30, 2020 was ₹ 2.2KCr, representing an Effective Tax Rate (“ETR”) of (36)% impacted by non-recognition of Deferred Tax Assets on UK tax losses and pension charges going through Other Comprehensive Income

Notes: Joint Operations refers to Fiat Automobiles Pvt Ltd and Tata Cummins Pvt Ltd

Enclosed more details